We are pleased to sahre with you a summary of the main conferences of POC 2023 that took place in Kuala Lumpur.

Thomas Mielke – Executive Director, ISTA Mielke GmbH – Oil World

- Palm oil prices will improve in the second half of 2023 on tightening supplies, and refined bleached deodorized (RBD) palm olein prices could jump to $1,150 per tonne on free-on-board basis.

- Palm oil exports from top producer Indonesia would decline in 2023 because of Jakarta’s ambitious biofuel mandate.

- Refined palm olein could jump to $1,150/T in H2 of 2023.

- Vegetable oil prices could rise in second half of 2023 and 2024 on rising biofuel demand.

IMPORTS:

- China’s soy oil and other veg. oils imports improving.

- China’s soybean imports in 2022/23 could rise to 97.2 mln t from 91.61 mln t yr ago.

EXPORTS:

- Indonesia’s palm oil exports to decline in 2023 because of rising local demand for biodiesel.

- Palm oil exports from producing countries to slow down from april-september.

OUTPUT:

- Indonesia’s 2023 palm oil output seen rising to 47.7 million tonne.

- Malaysia’s 2023 palm oil output seen rising to 19 million tonnes.

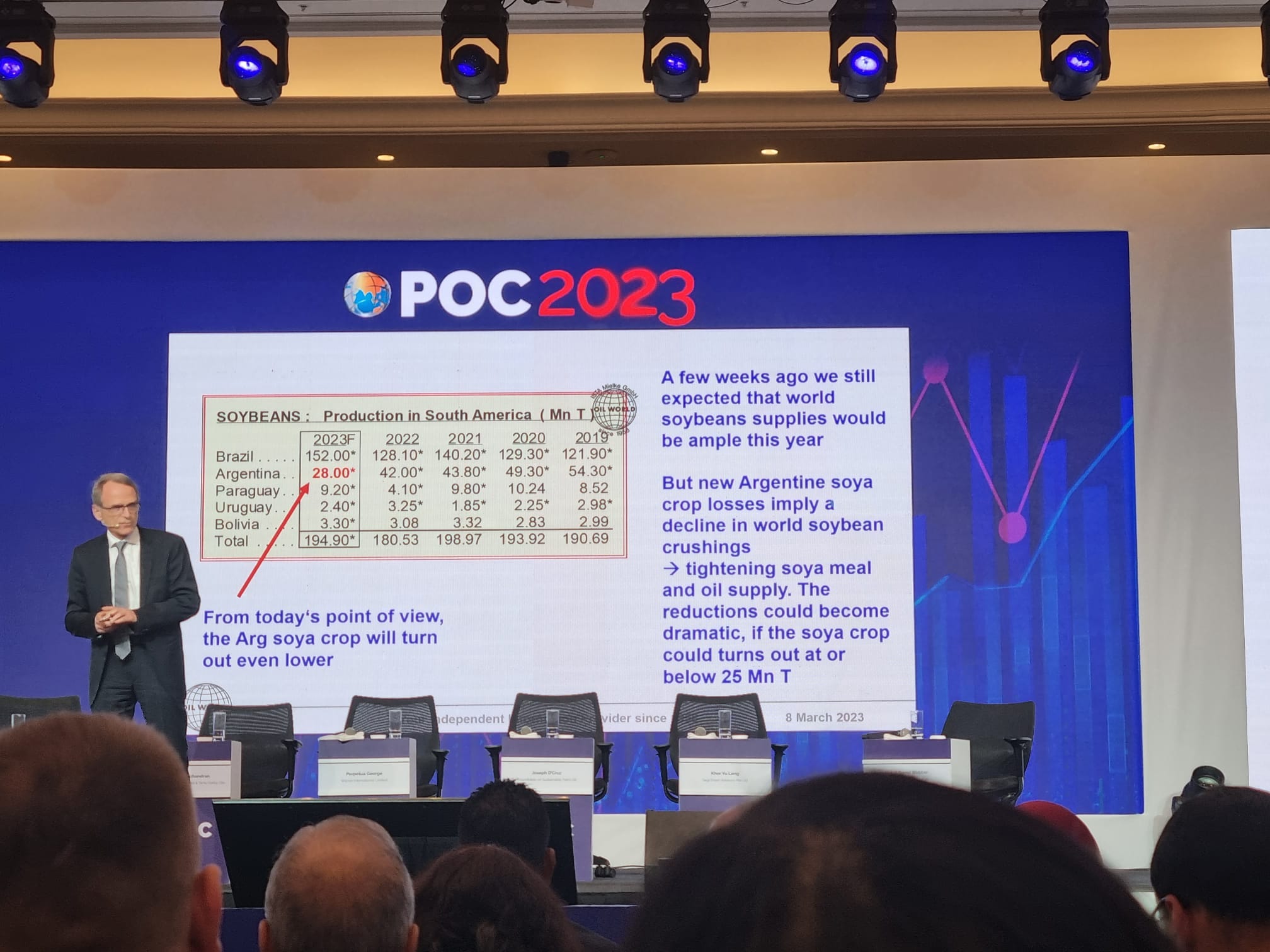

- Global soy oil output could drop by 1 mln t in 2022/2023.

- Global soybean output seen rising by 15 mln tonnes to 370 mln tonnes in 2022/2023.

- Argentina’s soybean output could fall to as low as 25 mln t in 2023.

Dr James Fry – Chairman, LMC International Limited

- Gently falling crude and slightly faster falls in gasoil prices.

- EU CPO will be $850 by December BMD 3rd position.

- CPO futures will be RM 3.350 by year-end, pulled down by gasoil.

- Annual averages for 2023 are $940/Mt for Rotterdam CPO and 3.700 RM for BMD.

Dorab Mistry – Director, Godrej International Trading & Investments Pte Ltd

- Malaysian palm oil is expected to trade between 4,000 and 5,000 ringgit ($1,106) per tonne from now until August as Indonesia’s ambitious biodiesel mandate will keep stocks tight in the first half of 2023.

- Malaysian stocks could drop below 2 million tonnes because of output disruptions caused by heavy rainfall and rising exports after rival Indonesia imposed curbs on its export.

- The palm oil market is likely to be influenced by the “vagaries of climate” in 2023 as a new El Niño weather pattern is forecast to develop. A new El Niño could drive prices higher so as to destroy demand. Without El Niño, we can see lower prices after August.

- Sunflower seed production in Ukraine could fall this year by as much as 30% from a year ago because of the ongoing war with Russia.