Vegetable oil prices at record levels have led to a more severe destruction of demand than expected. The drop in consumption combined with a negative macroeconomic scenario, strong fund sales and weakening energy prices have resulted in strong downward pressure on oils. After several weeks of declines, prices are back to pre-war levels.

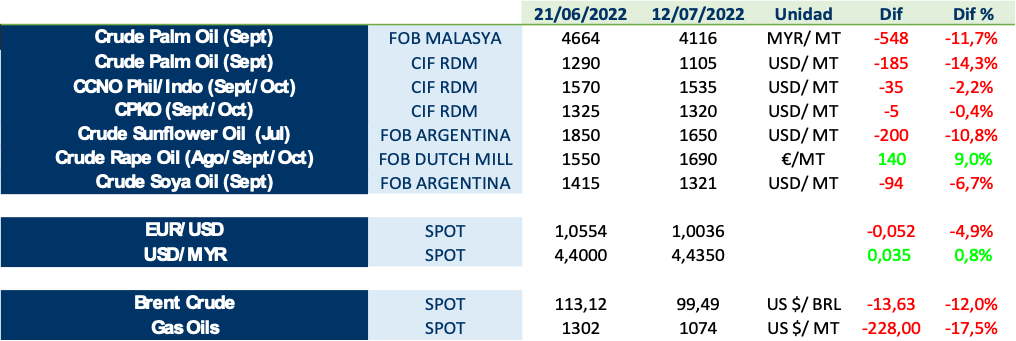

Below are the developments of some oils and other relevant factors of the last few weeks:

World oilseed production in the 22/23 season is estimated to reach 620.5 million tonnes, (+35.8 Mts vs. 21/22): practically all the growth comes from soybean, while the expected increase in rapeseed more than compensates for the losses in sunflower. With these figures, stocks would grow by 12.3 Mts: the big question is how this production will be available for the market.

For the first time since the 17/18 season, Oil World estimates an increase in the production of the 4 main oils (palm, soybean, rapeseed and sunflower). Key to sustaining these figures will be weather and crop developments in Canada, Russia, Ukraine and the European Union. As well as the North American cereal and oilseed crops now entering critical stages of development. For oil prices, it will also be important to follow closely palm exports and biofuel mandates in Indonesia and Malaysia. As well as the effects on world trade that the war in Ukraine may continue to have.

In this changing and uncertain scenario, we invite you to download and continue reading LIPSA’s market report.