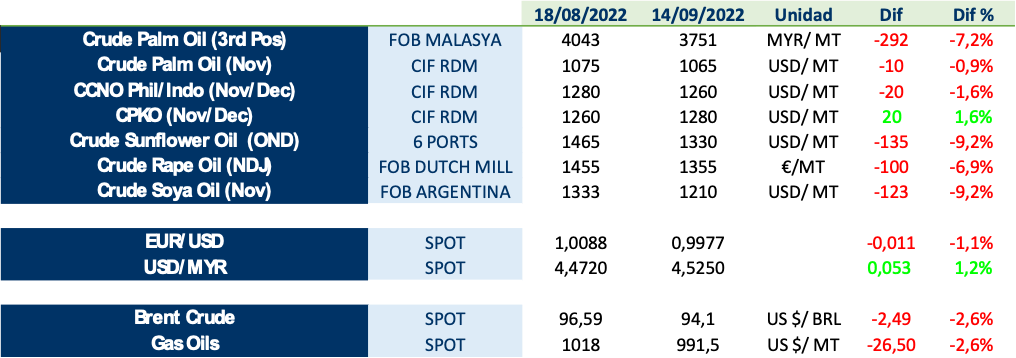

Vegetable oil prices have continued to fall in recent weeks, with the exception of palm kernel. The fall is particularly significant in palm and soybean. On the other hand, the depreciation of the euro has continued, sometimes trading below parity with the dollar.

Below is the evolution of some oils and other relevant factors in the last few weeks:

Indonesia’s palm oil stocks reached an all-time high in May, due to export restrictions imposed. However, utilisation for biodiesel and the large increase in exports, helped by tax adjustments, is helping to absorb these high levels. In Malaysia, labour shortages have not yet been resolved and could be a problem again in the near future.

On the sunflower side, despite the war, crushing volumes in Ukraine have recovered above expectations. This has added downward pressure to the market. A critical factor in the price evolution in the coming weeks is the export capacity of seeds and oils from Ukraine. If the export corridor were to close or reduce the flow, this would put a lot of stress on the market again.

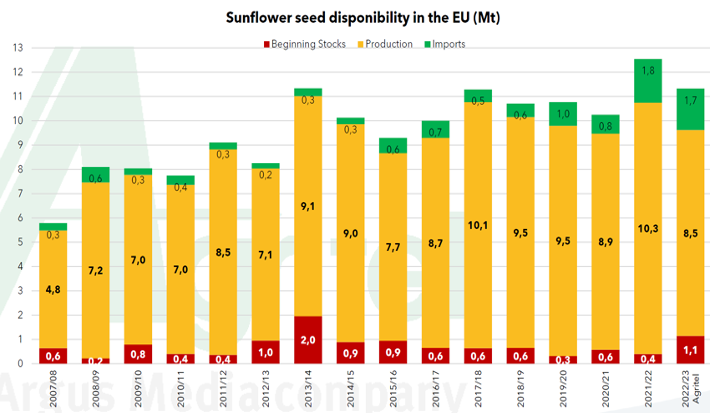

According to Agritel, this season’s harvest in the EU will be significantly lower than initially forecast and last season, due to low yields resulting from the high temperatures in much of Europe in recent months. As we can see below, their forecast for sunflower seed availability is lower than last season, even though it is based on higher initial stocks.

In this changing and uncertain scenario, we invite you to download and continue reading LIPSA’s market report above, where you will be able to get first-hand information on:

1. Vegetable oils under pressure

2. Imports of vegetable oils

3. Palm oil

4. Lauric oils (coconut and palm kernel)

5. Sunflower oil

6. Rapeseed oil

7. Soybean oil